In the beginning of 2023, the power supply in Norway had a total installed production capacity of 39 703 MW. In a normal year, the Norwegian power plants produce about 156 TWh. In 2021, Norway set a new production record with a total power production of 157.1 TWh. In 2022, there was low levels of water inflow to the reservoirs, and the total power production was 146.1 TWh.

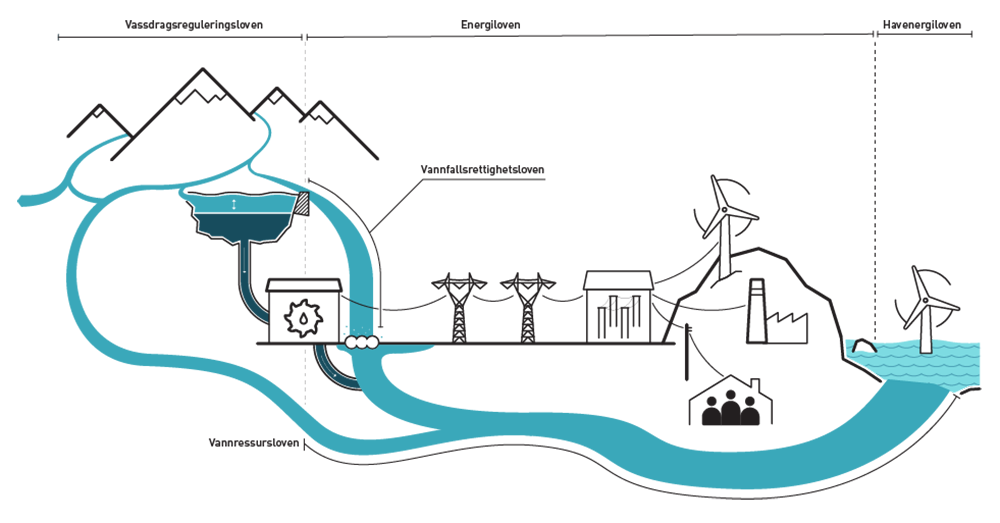

Hydropower accounts for most of the Norwegian power supply, and the resource base for production depends on the precipitation in a given year. This is a significant difference compared to the rest of Europe where security of supply is mainly secured through thermal power plants, with fuels available in the energy markets.

A special feature of the Norwegian hydropower system is its high storage capacity. Norway has half of Europe’s reservoir storage capacity, and more than 75 % of Norwegian production capacity is flexible. Production can be rapidly increased and decreased as needed, at low cost. This is important because there must be a balance between production and consumption at all times in the power system. The growing share of intermittent production technologies, such as wind and solar, makes it even more vital that there is flexibility available in the rest of the system.

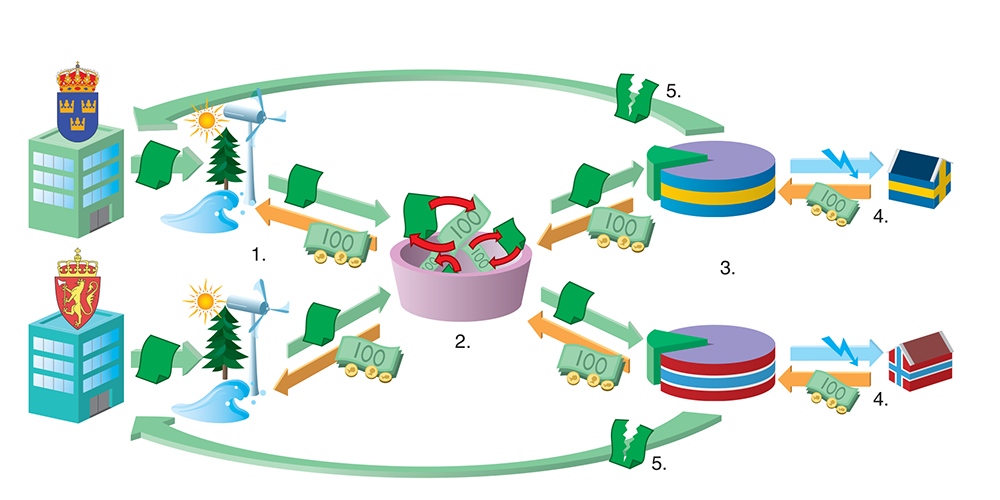

The power market in Norway was deregulated in 1991, when few countries had market-based power systems. The market is now a fundamental element of the Norwegian power supply. Electricity prices provide long-term investment signals and play an important part in short-term balancing of supply, demand and transmission.

Renewable power plants are generally located where there is access to resources. Production capacity is therefore unequally distributed between different regions of Norway. A well-developed power grid is vital for transmitting electricity to consumers in all parts of the country.

The Norwegian power system is closely integrated with the other Nordic systems, both in physical terms and through market integration. In turn, the Nordic market is integrated with the rest of Europe through cross-border interconnectors to the Netherlands, Germany, the Baltic states and Poland. Integration with other countries’ power systems, the well-developed power grid and the characteristics of hydropower production make Norway’s power supply system very flexible, reducing vulnerability to fluctuations in production between seasons and years.

Hydropower

Hydropower is still the mainstay of the Norwegian electricity system. At the beginning of 2023, there were 1 769 hydropower plants in Norway, with a combined installed capacity of 33 691 MW. In a normal year, the Norwegian hydropower plants produce 136.49 TWh, which is about 88% of Norway’s total power production.

Water inflow and installed capacity determine how much hydropower the Norwegian system can produce. Inflow varies considerably during the year and from one year to another. The water inflow is highest during the spring, normally declines towards the end of summer but increases again during the autumn. Inflow is generally very low in the winter months.

Norway has more than 1240 hydropower storage reservoirs with a total capacity of 87 TWh. The 30 largest reservoirs provide about half the storage capacity. Total reservoir capacity corresponds to 70% of annual Norwegian electricity consumption. Most of the reservoirs were constructed before 1990. Upgrading and expansion of hydropower plants has made it possible to utilize the reservoirs more fully.

Inflow, consumtion and production of electricity in Norway, 2024

Updated: 03.04.2025

Source: NVE

Print illustration Download data Inflow, consumtion and production of electricity in Norway, 2024 Download PDF Download as image (PNG)

Electricity production capacity is generally split into two categories, flexible and intermittent. If production is flexible, power plants can adjust production to market developments. Many power plants in Norway have storage reservoirs and production can therefore be adjusted within the constraints set by the licence and the watercourse itself.

Wind and solar power are intermittent; electricity can only be generated when the energy is available. The same applies to run-of-river power plants and small-scale hydropower plants. However a number of the large run-of-river power plants in Norway lie downstream of storage hydropower plants in the same river system, and this influences their production patterns. Some small hydropower plants make use of the head of water between reservoirs.

More than 75 % of Norway’s production capacity is flexible.

By using storage reservoirs, flexible hydropower plants can produce electricity even in periods when there is little precipitation and inflow is low. The large available reservoir storage capacity makes it possible to even out production over years, seasons, weeks and days, within the constraints set by the licence and the watercourse itself.

A high proportion of the energy used for heating in Norway is electricity, and electricity prices and production from storage hydropower plants are therefore generally highest in winter.

Production of intermittent hydropower automatically varies with changes in water inflow. Production is high during spring and summer, when consumption is lowest.

The flexibility of power plants and reservoirs varies. Some hydropower plants with small reservoirs offer short-term flexibility, and can transfer production from base-load hours (at night) to peak-load hours (daytime). Hydropower plants with larger reservoirs can store water for longer periods so that they produce electricity in winter, when consumption and prices are highest. Norway’s largest reservoir, Blåsjø, has a capacity of 7.8 TWh and can hold three years’ normal inflow. However, when the hydropower plants are working at full capacity, the reservoir could be emptied in 7–8 months. Very large reservoirs like Blåsjø are intended to store water in years when precipitation is high for use in drier years. Much of Norway’s reservoir capacity is concentrated in the mountains in the southern half of the country (in the counties Telemark, Rogaland, Hordaland and Sogn og Fjordane), and further north in Nordland.

Reservoirs make it possible to manage water use to maximise income from the available water resources. For society as a whole, the aim is to spread production so as to make optimal use of water inflow over the year, or in some cases over several years. To ensure that this happens, there must be financial incentives for producers that reflect the underlying physical conditions. The market therefore plays an important part in ensuring efficient management of water stored in the reservoirs.

The variable costs of hydropower production are low, since water, the actual energy source, is free. An owner of a run-of-river power plant will therefore be willing to generate electricity even if the prices is only just above zero. The same principle applies to intermittent production technologies such as wind and solar power. Intermittent production is generally independent of price, but varies with weather conditions. Thermal power production, for example at coal-fired, gas-fired and nuclear power plants, is profitable provided that the electricity price covers the production costs at the time of production. These depend to a large degree on the prices of coal, gas and CO2 emission allowances.

Hydropower producers who can store water will assess the situation differently. They constantly need to consider whether to produce electricity immediately, or to retain the water in reservoirs. It is the difference between the current and the expected electricity price that determines whether it is profitable to store water for short or longer periods.

It is challenging to manage storage reservoirs, because it is impossible to be sure how inflow will vary in future or how market conditions will develop. Reservoir management therefore requires considerable local knowledge and the ability to interpret changing, complex and uncertain information on inflow, consumption and market developments.

At Norwegian storage hydropower plants, production is also regulated in line with short-term price developments, which are closely related to the volume of intermittent power production in the other Nordic countries and the rest of Europe.

It is also necessary to maintain a balance in the power supply system as a whole as production and consumption change during the day and within each hour. Hydropower production can be rapidly regulated up and down at relatively low cost. In thermal power plants, on the other hand, it can be time-consuming and costly to regulate production. This means that Norwegian power plants are useful for meeting the short-term need for flexibility, which is growing because the share of intermittent production is increasing in Nordic and other European power supply systems. Well-functioning, integrated markets and a well-developed power grid are an essential basis for this.

Wind power

At the beginning of 2023, there were 65 wind farms in Norway, with an installed capacity of 5073 MW. This corresponds to about 16.9 TWh in a normal year. Production from wind power plants fluctuates with weather conditions. Wind conditions can vary a lot between days, weeks and months.

Wind power production in Norway

Updated: 23.04.2025

Source: SSB

Print illustration Download data Wind power production in Norway Download PDF Download as image (PNG)

Solar power

At the beginning of 2023, the total installed capacity of solar power was 299 MW in Norway. In 2023, more than 90% of the installed capacity was connected to the Norwegian power grid. About 5% of the solar power in Norway had an installed capacity of more than 50 kW in 2023. In 2023, most of the solar power in Norway is installed on the roofs of households and industry, and primarily cover their own consumption. As of 31 March 2023, there are no dedicated solar power plants in Norway. During 2022, approximately 153 MW of new solar power was installed in Norway.

Development in grid-connected installed capacity for solar power in Norway

Updated: 23.04.2025

Source: Elhub and NVE

Print illustration Download data Development in grid-connected installed capacity for solar power in Norway Download PDF Download as image (PNG)

Thermal power plants

Norway’s thermal power plants accounted for about 1.5% of the total production capacity in 2023. Many of the power plants are located in large industrial installations that use the electricity generated themselves. Hence, production often depends on the electricity needs of the industry. These power plants use a variety of energy sources, including municipal waste, industrial waste, surplus heat, oil, natural gas and coal. There are 30 thermal power plants in Norway, with a total installed capacity of about 642 MW.

The power balance

The power balance expresses the relationship between production and consumption and indicates whether the Norwegian power system is a net exporter or importer in a particular year. There are wide variations from year to year. Generally, consumption fluctuates with temperature and production with water inflow and wind conditions. The underlying situation in the Norwegian power supply system can be illustrated by comparing Norwegian production capacity in a normal year with electricity consumption corrected for temperature, as in the figure below.

At the beginning of the 1990s, there was a considerable surplus in the Norwegian power supply system, which became apparent when the market was deregulated. This was followed by a period of falling investments in new electricity production and relatively high growth in consumption, resulting in a reduction in the power surplus by the early 2000s. After the 2008–2009 financial crisis, the power surplus has increased again as a result of weaker growth in consumption and higher electricity production. In 2022, Norway had a power surplus of 12.5 TWh. There is great uncertainty in how the power surplus will evolve in the years to come, and this depends on a wide range of factors. In the years to come, a high increase in power consumption is expected, which may contribute to a lower power surplus.

Normalized production and consumption of electricity 1990-2020, TWh

Updated: 23.02.2021

Source: NVE, Nordpool

Print illustration Download data Normalized production and consumption of electricity 1990-2020, TWh Download PDF Download as image (PNG)